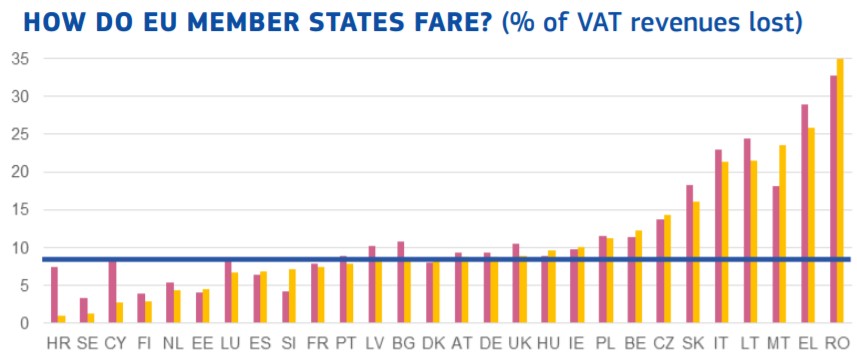

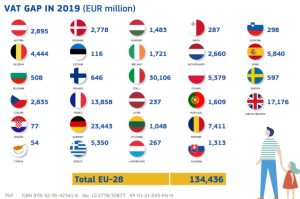

VAT Gap: While gap continues to decrease, EU countries lost €134 billion in VAT revenues in 2019 - VATupdate

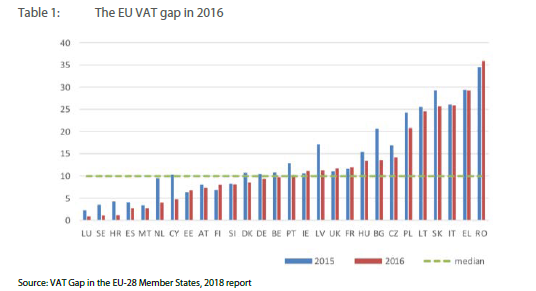

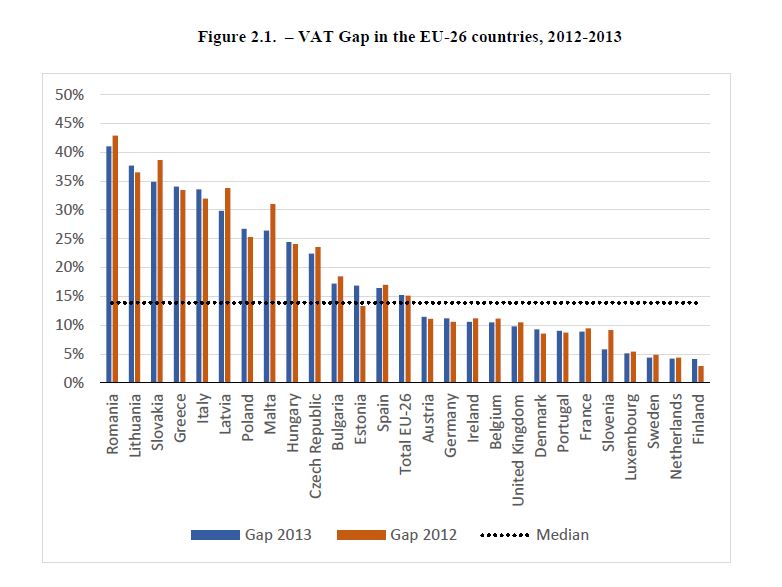

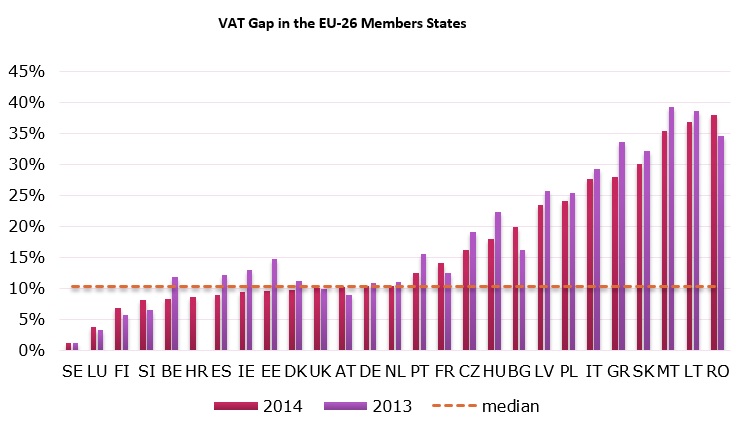

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

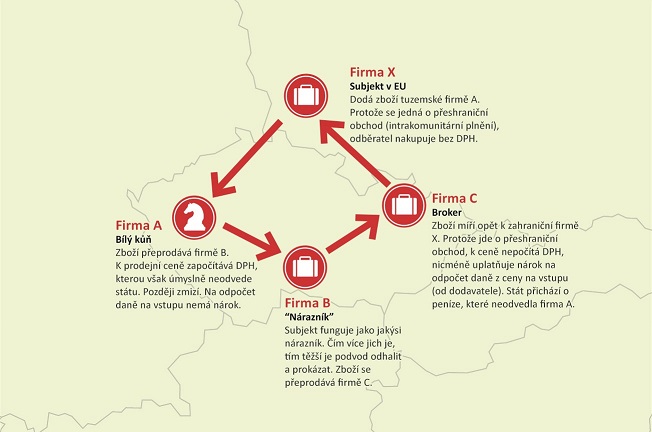

VAT non-compliance costs in Europe fell to €160 billion - CASE - Center for Social and Economic Research